Tally Prime Case Study 1 Exercise

Index

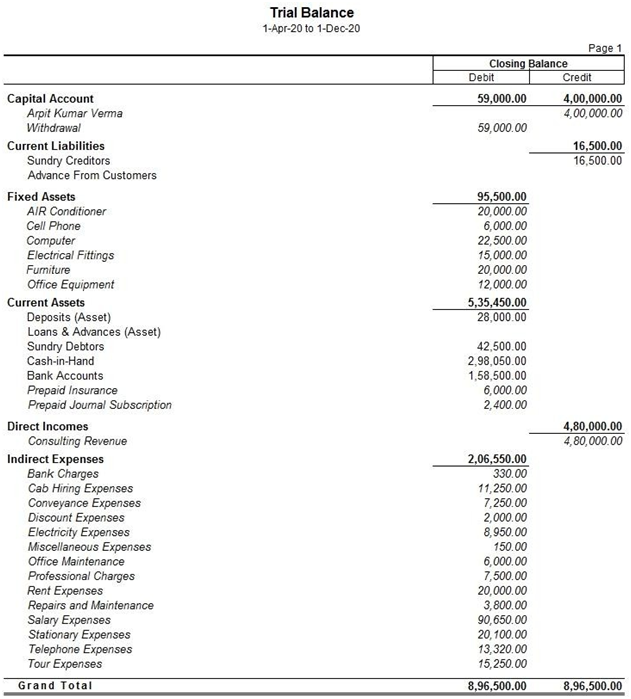

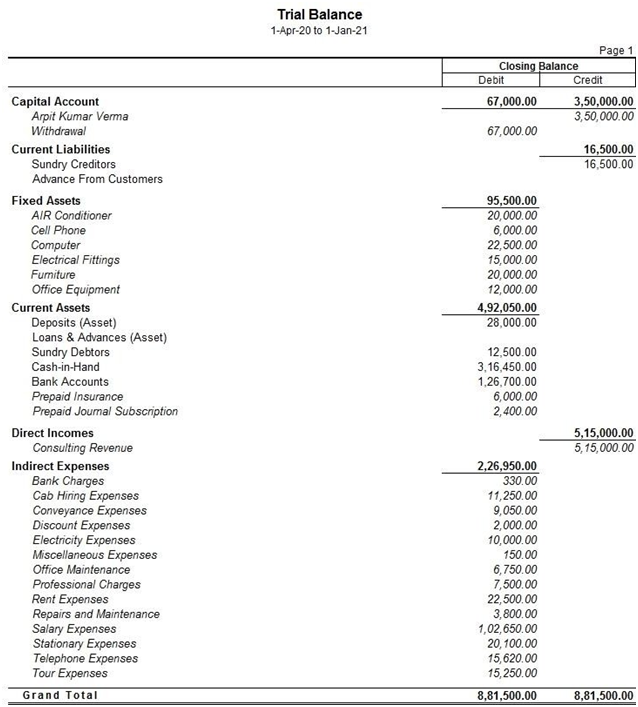

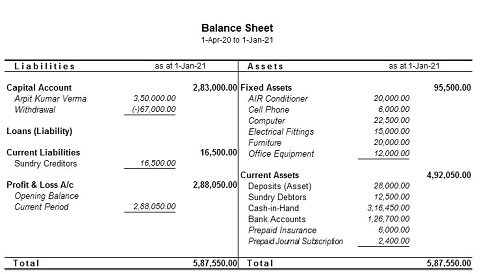

APRIL 2020——————————————- 2

August 2020—————————————- 12

September 2020———————————- 15

October 2020————————————– 17

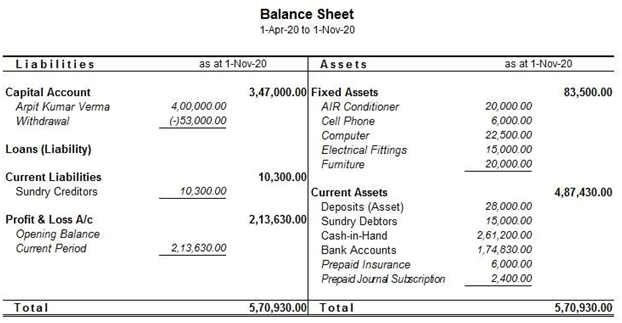

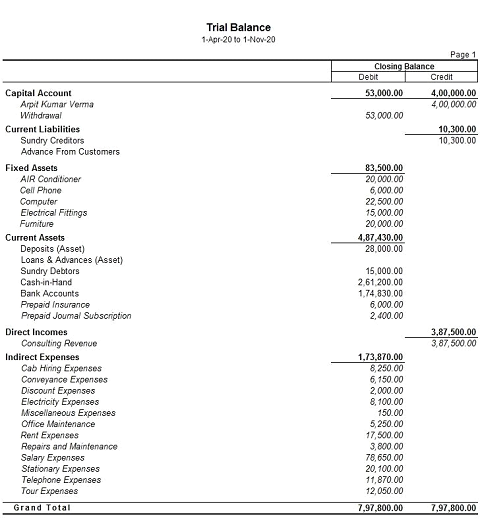

November 2020———————————– 20

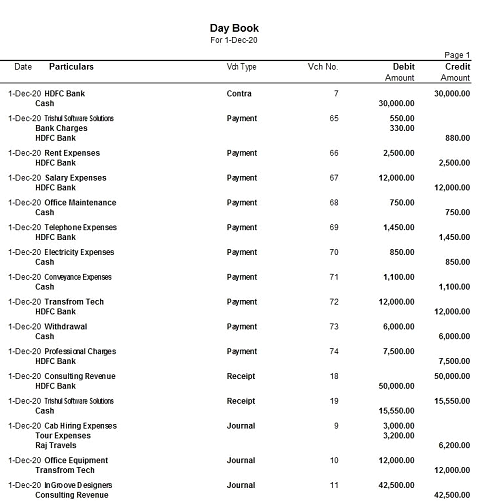

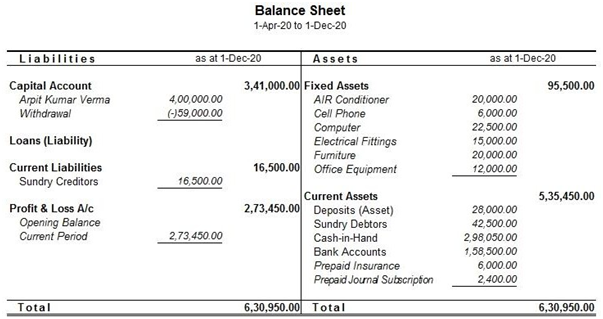

December 2020———————————– 22

January 2021————————————– 26

February 2021————————————- 28

March 2021—————————————- 30

Provision Entries———————————- 33

Depreciation Entries—————————– 33

Adjustment Entries—————————— 34

Other Adjustment Entries———————- 34

Closing Entry————————————— 34

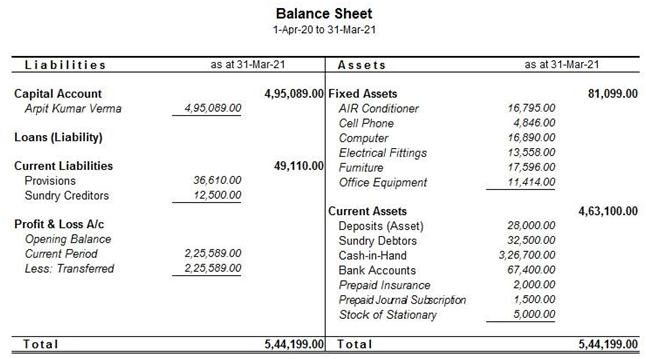

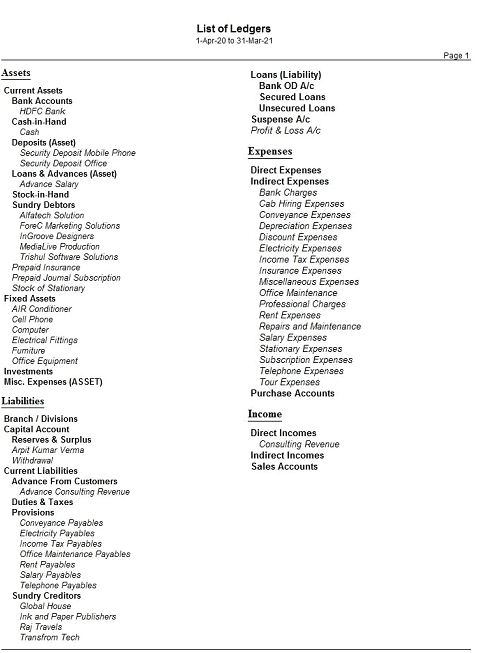

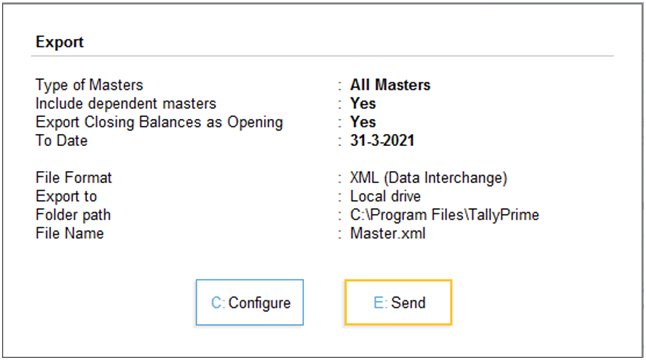

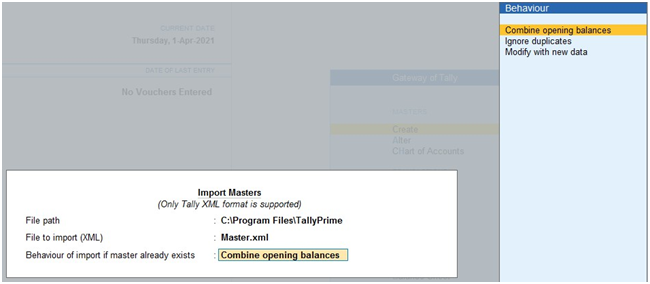

Export Closing Balance with All Masters. Import Master with Combine opening balance.

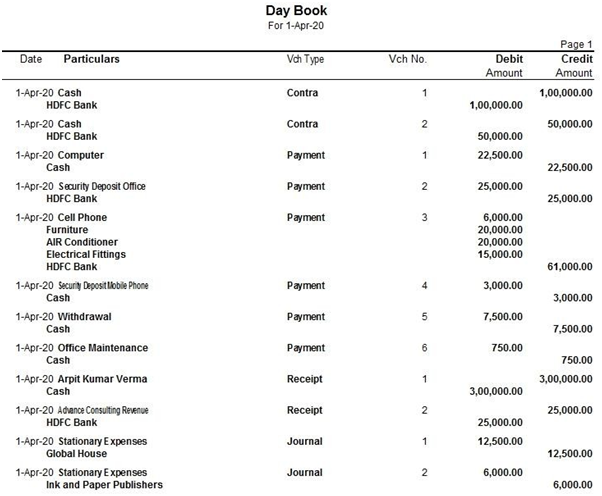

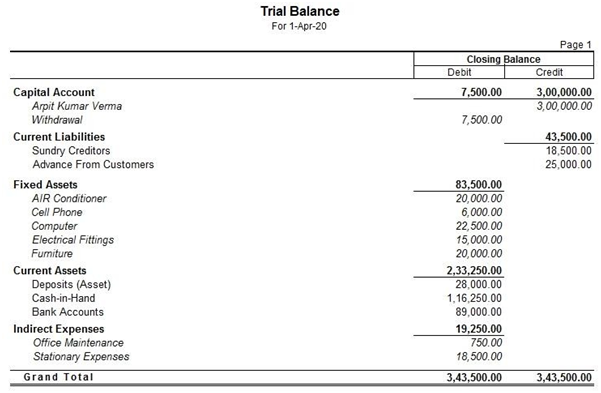

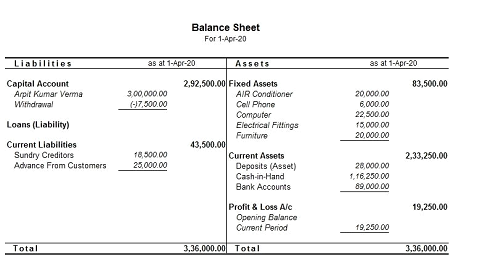

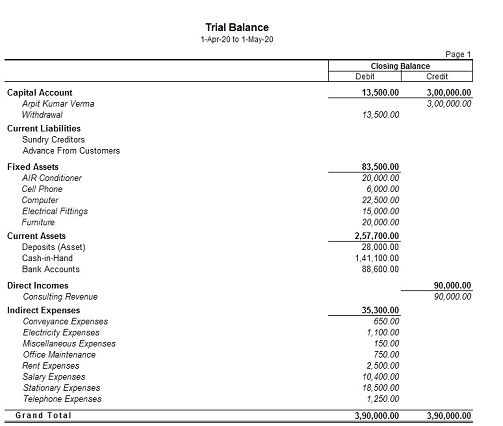

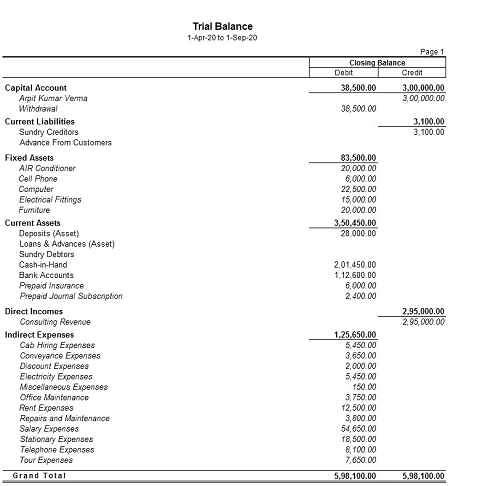

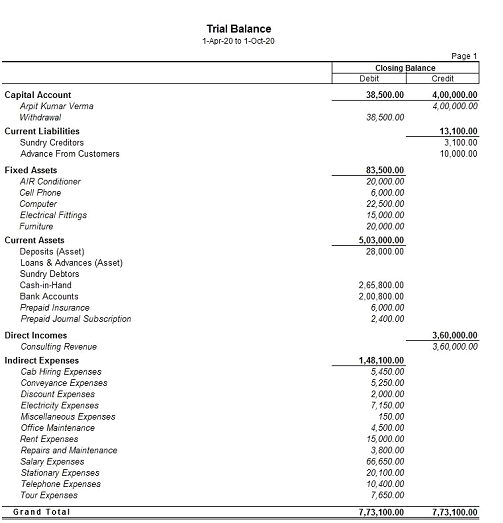

APRIL 2020 | ||

1 | 1-4-2020 | Arpit Kumar Verma started a business solutions by bringing in cash of Rs.300000. |

2 | 2-4-2020 | Mr. Verma paid Rs.22500 in cash to purchase a computer. The computer does not have any disposal value at the end of its useful life of four years. |

3 | 3-4-2020 | Mr. Verma opened a bank account in HDFC Bank and deposit cash of Rs.100000. |

4 | 4-4-2020 | Mr. Verma rented an office apace for Rs.2500 per month on April 01, 2020 He paid the security deposit of Rs. 25000 by cheque. |

5 | 5-4-2020 | Mr. Verma hired Shubham as Manager on a monthly salary of Rs.7500. He also hired Geeta Shukla as Assistant Manager on a Monthly salary of Rs.4500. |

6 | 10-4-2020 | Mr. Verma made an arrangement with Raj Travels to receive bills, for travel expenses, at regular intervals. |

7 | 15-4-2020 | Mr. Verma issued cheque and purchased the following fixed assets. |

8 | 16-4-2020 | Mr. Verma obtained a mobile phone subscription from Planet telecommunications, by paying a deposit of Rs.3000 in cash. |

9 | 20-4-2020 | Mr.Verma purchased stationary consumables worth Rs.12500 from Global House, on credit. |

10 | 21-4-2020 | Mr. Verma signed a contract with Silver Services to provide consultancy services at an agreed price of Rs.75000. He received an advance of Rs.25000 by cheque. |

11 | 23-4-2020 | Mr. Verma deposit Rs.50000 cash in HDFC Bank. |

12 | 25-4-2020 | Mr. Verma received an invoice for Rs.6000 from Ink and Paper Publishers for printing office stationary. |

13 | 27-4-2020 | Mr. Verma withdrew Rs.7500 cash for personal use. |

14 | 30-4-2020 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

May 2020 | ||

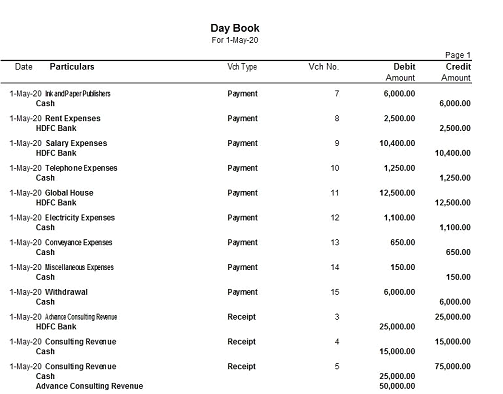

15 | 1-5-2020 | Mr. Verma paid Rs.6000 in cash to Ink and paper publishers. |

16 | 5-5-2020 | Mr. Verma paid Rs.2500 by cheque towards office rent for April 2020. |

17 | 6-5-2020 | Mr. Verma paid salaries through cheque for April 2020 (25 days) to Shubham Rs.6500, Geeta Shukla Rs.3900. |

18 | 7-5-2020 | Mr. Verma received and paid her mobile phone bill amounting to Rs.1250 in cash. |

19 | 10-5-2020 | Mr. Verma issued a cheque of Rs.12500 to Global House. |

20 | 12-5-2020 | Mr. Verma paid Rs.1100 in cash towards electricity charges. |

21 | 14-5-2020 | Mr. Verma received a further advance of Rs.25000 from silver services by cheque. (Refer transaction 10.) |

22 | 15-5-2020 | Mr. Verma reimbursed conveyance bills amounting to Rs.650 in cash to Geeta Shukla. |

23 | 18-5-2020 | Mr. Verma paid Rs.150 in cash towards miscellaneous office expenses. |

24 | 20-5-2020 | Mr. Verma received Rs.15000 as consulting revenue in cash from Omega Infotech. |

25 | 25-5-2020 | Mr. Verma raised an invoice for Rs.75000 on Silver Services after completion of the service. Silver Services paid the balance amount of Rs.25000 in cash after deducting the advance. (Refer transactions 10 and 21.) |

26 | 28-5-2020 | Mr. Verma withdrew Rs.6000 cash for personal use. |

June 2020 | ||

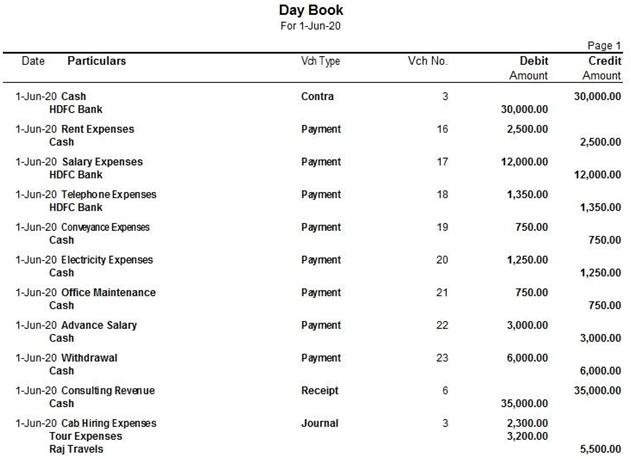

27 | 3-6-2020 | Mr. Verma paid Rs.2500 in cash towards office rent. |

28 | 4-6-2020 | Mr. Verma paid salaries by cheque for May 2020 (Refer transaction 5.) |

29 | 5-6-2020 | Mr. Verma received an invoice for Rs.5500 from Raj travels. This includes Rs.2300 towards cab hiring charges and Rs.3200 towards outstation tours. |

30 | 9-6-2020 | Mr. Verma received Rs.35000 in cash as consulting revenue from eateries food chain. |

31 | 10-6-2020 | Mr. Verma deposited Rs.30000 in HDFC Bank. |

32 | 15-6-2020 | Mr. Verma paid mobile phone bill amounting to Rs.1350 by cheque. |

33 | 16-6-2020 | Mr. Verma reimbursed conveyance bills amounting to Rs.750 in cash to Geeta Shukla. |

34 | 20-6-2020 | Mr. Verma paid Rs.1250 in cash towards electricity bill charges. |

35 | 21-6-2020 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

36 | 23-6-2020 | Mr. Verma paid Rs.3000 in cash as salary advance to Shubham. |

37 | 27-6-2020 | Mr. Verma withdrew Rs.6000 cash for personal use. |

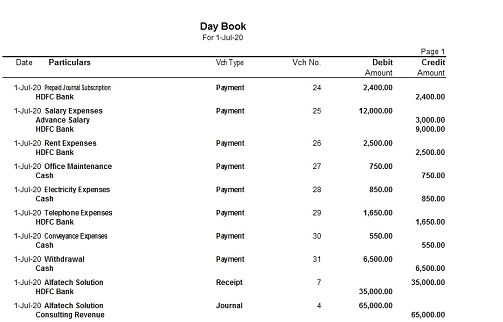

July 2020 | ||

38 | 3-7-2020 | Mr. Verma raised an invoice for Rs.65000 on Alfatech Solution for services provided. |

39 | 6-7-2020 | Mr. Verma subscribed for the Management Consultant journal paying Rs.2400 by cheque. The subscription period is from July 2020 to June 2022. |

40 | 7-7-2020 | Mr. Verma paid salaries for June 2020 by cheque. Salary advance paid to Shubham is adjusted against the salary paid. (Refer transaction 36.) |

41 | 10-7-2020 | Mr. Verma paid office rent by cheque. (Refer transaction 4.) |

42 | 15-7-2020 | Mr. Verma received Rs.35000 by cheque from Alfatech solutions. |

43 | 18-7-2020 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

44 | 19-7-2020 | Mr. Verma paid Rs.850 in cash towards electricity charges. |

45 | 20-7-2020 | Mr. Verma paid Rs.1650 by cheque as mobile phone bill charges. |

46 | 25-7-2020 | Mr. Verma reimburses conveyance bills of Rs.550 in cash to Geeta Shukla. |

47 | 27-7-2020 | Mr. Verma withdrew Rs.6500 cash for personal use. |

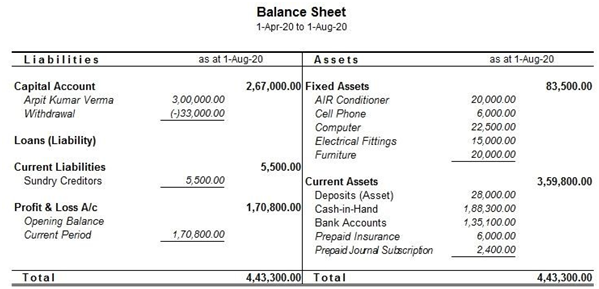

August 2020 | ||

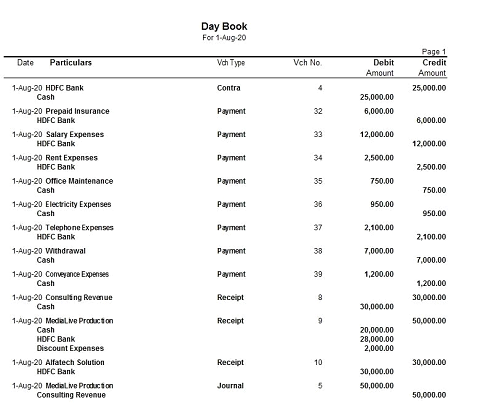

48 | 1-8-2020 | Mr. Verma paid by cheque Rs.6000 for insurance of fixed assets. The period of insurance is from August 1, 2020 to July 31, 2021. |

49 | 2-8-2020 | Mr. Verma received Rs.30000 in cash as consulting revenue from ABC Computer. |

50 | 5-8-2020 | Mr. Verma paid salaries by cheque. |

51 | 10-8-2020 | Mr. Verma paid office rent by cheque. |

52 | 12-8-2020 | Mr. Verma withdrew Rs.25000 from HDFC Bank. |

53 | 14-8-2020 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

54 | 16-8-2020 | Mr. Verma raised an invoice for Rs.50000 on MediaLive Productions for services provided. |

55 | 18-8-2020 | Mr. Verma paid Rs.950 in cash towards electricity charges. |

56 | 20-8-2020 | Mr. Verma paid Rs.2100 by cheque towards mobile phone bill charges. |

57 | 21-8-2020 | MediaLive Productions settled the bill for a final amount of Rs.48000 by paying Rs.20000 in cash and Rs.28000 by cheque. (Refer transaction 54.) |

58 | 27-8-2020 | Mr. Verma withdrew Rs.7000 cash for personal use. |

59 | 28-8-2020 | Mr. Verma received Rs.30000 by cheque from Alfatech Solutions. |

60 | 29-8-2020 | Mr. Verma reimbursed conveyance bills amounting to Rs.1200 in cash to Geeta Shukla. |

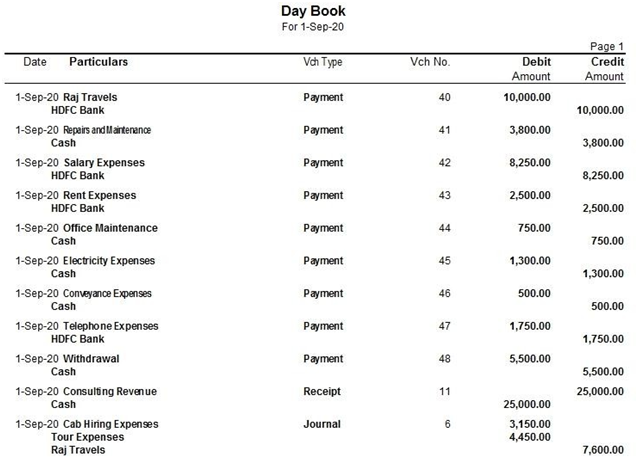

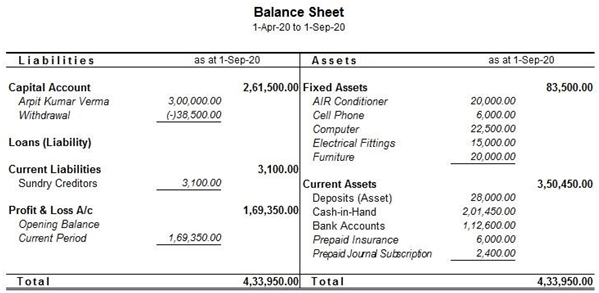

September 2020 | ||

61 | 2-9-2020 | Mr. Verma paid Rs.3800 in cash for repairs and maintenance of office premises. |

62 | 5-9-2020 | Mr. Verma paid salaries by cheque. As Shubham was on leave for 15 days, he was paid half-month’s salary. |

63 | 8-9-2020 | Mr. Verma paid rent by cheque. |

64 | 9-9-2020 | Mr. Verma received an invoice for Rs.7600 from Raj Travels. This includes Rs.3150 towards cab hiring charges and Rs.4450 towards outstation tours. |

65 | 12-9-2020 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

66 | 15-9-2020 | Mr. Verma received Rs.25000 in cash as consulting revenue from Cam and Cut Productions. |

67 | 17-9-2020 | Mr. Verma paid Rs.1300 in cash towards electricity charges. |

68 | 20-9-2020 | Mr. Verma reimbursed conveyance bills amounting to Rs.500 in cash |

69 | 23-9-2020 | Mr. Verma paid Rs.10000 by cheque to Raj Travels. |

70 | 24-9-2020 | Mr. Verma paid Rs.1750 by cheque towards mobile phone bill charges. |

71 | 28-9-2020 | Mr. Verma withdrew Rs.5500 cash for personal use. |

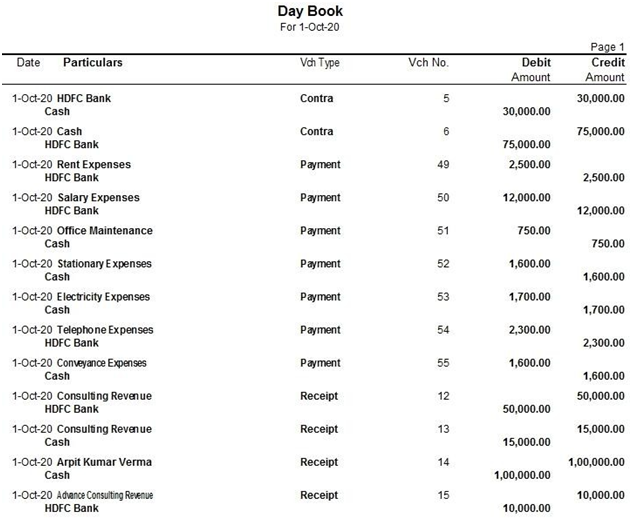

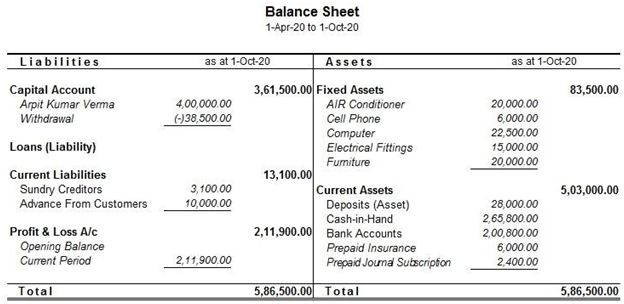

October 2020 | ||

72 | 3-10-2020 | Mr. Verma received Rs.50000 by cheque as consulting revenue from Xceed International Couriers. |

73 | 5-10-2020 | Mr. Verma paid office rent by cheque. |

74 | 7-10-2020 | Mr. Verma withdrew Rs.30000 cash from HDFC Bank. |

75 | 8-10-2020 | Mr. Verma paid salaries by cheque. |

76 | 10-10-2020 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

77 | 12-10-2020 | Mr. Verma purchased stationary items worth Rs.1600 in cash. |

78 | 15-10-2020 | Mr. Verma received Rs.15000 in cash as consulting revenue from Samaritan Products. |

79 | 18-10-2020 | Mr. Verma paid Rs.1700 in cash towards electricity charges. |

80 | 20-10-2020 | Mr. Verma paid Rs.2300 by cheque towards mobile phone bill charges. |

81 | 23-10-2020 | Mr. Verma introduced further capital into the firm by bringing in cash of Rs.100000. |

82 | 24-10-2020 | Mr. Verma deposit cash amounting to Rs.75000 in HDFC Bank. |

83 | 26-10-2020 | Mr. Verma reimbursed conveyance bills amounting to Rs.1600 in cash to Geeta Shukla. |

84 | 28-10-2020 | Mr. Verma entered into a contract with Planet Consultancy for providing service at an agreed price of Rs.35000. An advance of Rs.10000 was received by cheque. |

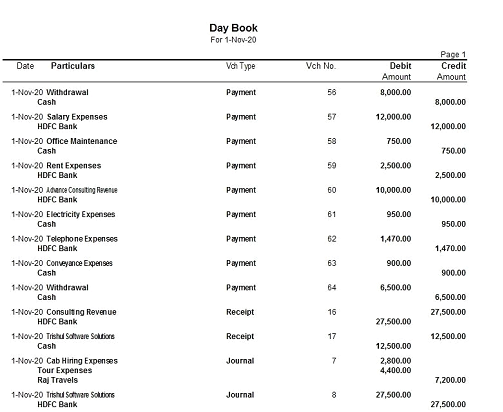

November 2020 | ||

85 | 1-11-2020 | Mr. Verma withdrew Rs.8000 cash for personal use. |

86 | 2-11-2020 | Mr. Verma received an invoice for Rs.7200 from Raj Travels. This includes Rs.2800 towards cab hiring charges and Rs.4400 towards outstation tours. |

87 | 5-11-2020 | Mr. Verma paid salaries by cheque. |

88 | 8-11-2020 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

89 | 10-11-2020 | Mr. Verma received Rs.27500 by cheque as consulting revenue form Trishul Software Solutions. |

90 | 12-11-2020 | Mr. Verma paid office rent by cheque. |

91 | 15-11-2020 | Planet Consultancy terminated their contract and the advance of Rs.10000 was refunded to them by cheque. |

92 | 20-11-2020 | HDFC Bank intimated Mr. Verma that the cheque of Trishul Software solutions for Rs.27500 had bounced. Trishul Software solutions was informed of this development and they promised to pay the amount in a few days. (Refer Transaction 89.) |

93 | 21-11-2020 | Mr. Verma paid Rs.950 in cash towards electricity bill charges. |

94 | 23-11-2020 | Mr. Verma received Rs.12500 in cash Trishul software solutions. |

95 | 25-11-2020 | Mr. Verma paid Rs.1470 by cheque towards mobile phone bill charges. |

96 | 27-11-2020 | Mr. Verma reimbursed conveyance bills amounting to Rs.900 in cash to Geeta Shukla. |

97 | 30-11-2020 | Mr. Verma withdrew Rs.6500 cash for personal use. |

December 2020 | ||

98 | 3-12-2020 | The statement received from HDFC Bank, shows that the bank has charged Rs.550 as cheque bouncing charges and Rs330 as cheque book charges. Cheque bouncing charges are to be recovered from Trishul Software solutions (Refer transaction 92.) |

99 | 5-12-2020 | Mr. Verma paid office rent by cheque. |

100 | 6-12-2020 | Mr. Verma paid salaries by cheque. |

101 | 8-12-2020 | Mr. Verma received an invoice from Raj Travels for Rs.6200. This includes Rs.3000 towards cab hiring charges and Rs.3200 towards outstation tours. |

102 | 9-12-2020 | Mr. Verma received Rs.50000 by cheque as consulting revenue form Unigrand Technologies. |

103 | 10-12-2020 | Mr. Verma withdrew Rs.30000 cash from HDFC Bank. |

104 | 11-12-2020 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

105 | 15-12-2020 | Mr. Verma purchased office equipment worth Rs.12000 on credit from Transfrom Tech. The assets does not have any disposal value after its useful life of 6 years. |

106 | 16-12-2020 | Mr. Verma paid Rs.1450 by cheque towards mobile phone bill charges. |

107 | 18-12-2020 | Mr. Verma paid Rs.850 in cash towards electricity bill charges. |

108 | 20-12-2020 | Mr. Verma reimbursed conveyance bills amounting to Rs.1100 in cash to Geeta Shukla. |

109 | 23-12-2020 | Mr. Verma paid Rs.12000 by cheque to transform tech. |

110 | 21-12-2020 | Mr. Verma raised an invoice for Rs. 42500 on InGroove Designers for consultancy services. |

111 | 25-12-2020 | Mr. Verma received Rs.15550 in cash from trishul software solutions. |

112 | 28-12-2020 | Mr. Verma withdrew Rs.6000 cash for personal use. |

113 | 30-12-2020 | Mr. Verma paid Rs.7500 by cheque towards professional charges for internal audit of accounts. |

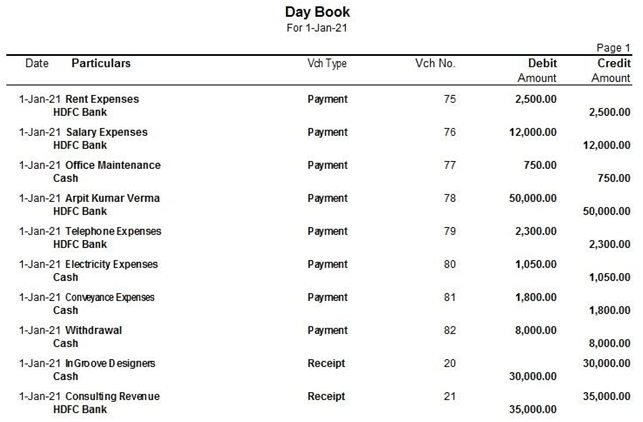

January 2021 | ||

114 | 3-1-2021 | Mr. Verma paid office rent by cheque. |

115 | 5-1-2021 | Mr. Verma received Rs.30000 in cash from InGroove Designers. |

116 | 6-1-2021 | Mr. Verma paid salaries by cheque. |

117 | 10-1-2021 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

118 | 12-1-2021 | Mr. Verma received Rs.35000 by cheque as consulting revenue from Ala Carte Investments. |

119 | 15-1-2021 | Mr. Verma withdrew Rs.50000 capital from the firm by cheque. |

120 | 18-1-2021 | Mr. Verma paid Rs.2300 by cheque as mobile phone bill charges. |

121 | 21-1-2021 | Mr. Verma paid Rs.1050 in cash towards electricity charges. |

122 | 23-1-2021 | Mr. Verma reimbursed conveyance bills amounting to Rs.1800 in cash to Geeta Shukla. |

123 | 30-1-2021 | Mr. Verma withdrew Rs.8000 cash for personal use. |

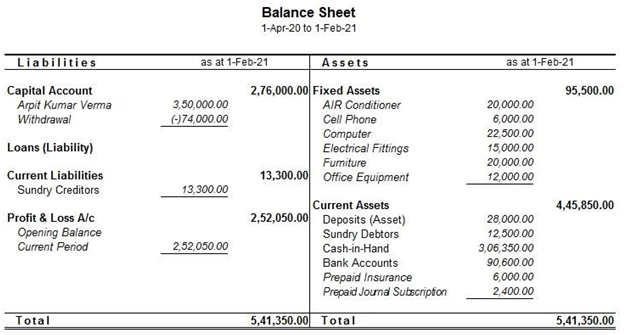

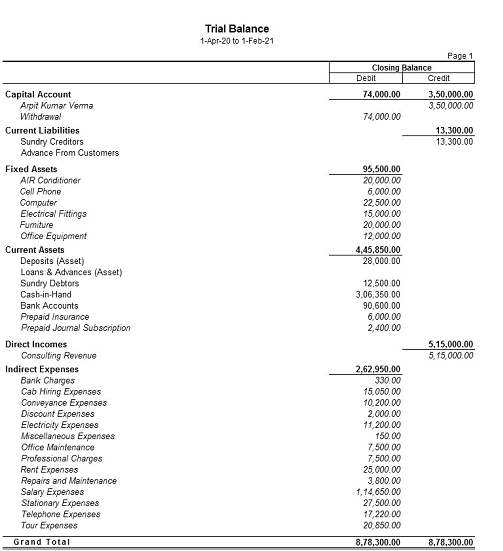

February 2021 | ||

124 | 5-2-2021 | Mr. Verma paid office rent by cheque. |

125 | 6-2-2021 | Mr. Verma paid salaries by cheque. |

126 | 10-2-2021 | Mr. Verma received an invoice from Raj Travels for Rs.9400. This includes Rs.3800 towards cab hiring charges and Rs.5600 towards outstation tours. |

127 | 11-2-2021 | Mr. Verma paid Rs.20000 by cheque to Raj Travels. |

128 | 12-2-2021 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

129 | 15-2-2021 | Mr. Verma paid Rs.1600 by cheque towards mobile phone bill charges. |

130 | 18-2-2021 | Mr. Verma paid Rs.1200 in cash towards electricity bill. |

131 | 20-2-2021 | Mr. Verma reimbursed conveyance bills of Rs.1150 in cash to Geeta Shukla. |

132 | 24-2-2021 | Mr. Verma purchased stationary worth Rs.7400 on credit from Global House. |

133 | 28-2-2021 | Mr. Verma withdrew Rs.7000 cash for personal use. |

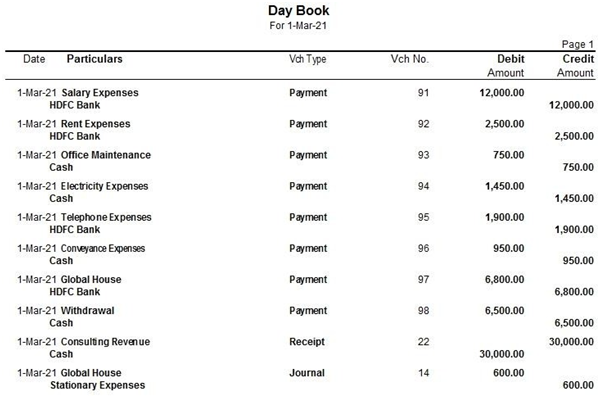

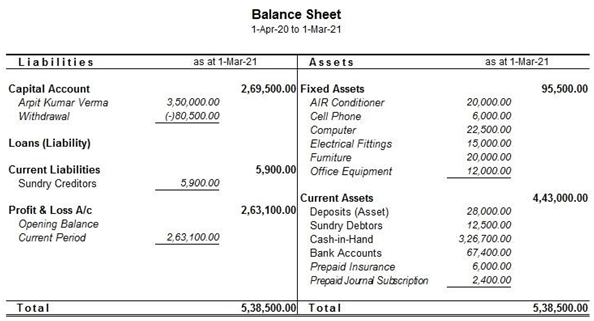

March 2021 | ||

134 | 3-3-2021 | Mr. Verma paid salaries by cheque. |

135 | 5-3-2021 | Mr. Verma paid office rent by cheque. |

136 | 8-3-2021 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

137 | 10-3-2021 | Mr. Verma received Rs.30000 in cash as consulting revenue from Eye Television Network. |

138 | 12-3-2021 | Mr. Verma paid Rs.1450 in cash towards electricity bill. |

139 | 15-3-2021 | Mr. Verma paid Rs.1900 by cheque towards mobile phone bill charges. |

140 | 18-3-2021 | Mr. Verma reimbursed conveyance bills of Rs.950 in cash Geeta Shukla. |

141 | 20-3-2021 | The invoice received from Global House on February 24, 2021 had an error in calculation and was over-valued by Rs.600. |

142 | 21-3-2021 | Mr. Verma paid Rs.6800 by cheque to Global House. |

143 | 25-3-2021 | Mr. Verma withdrew Rs.6500 cash for personal use. |

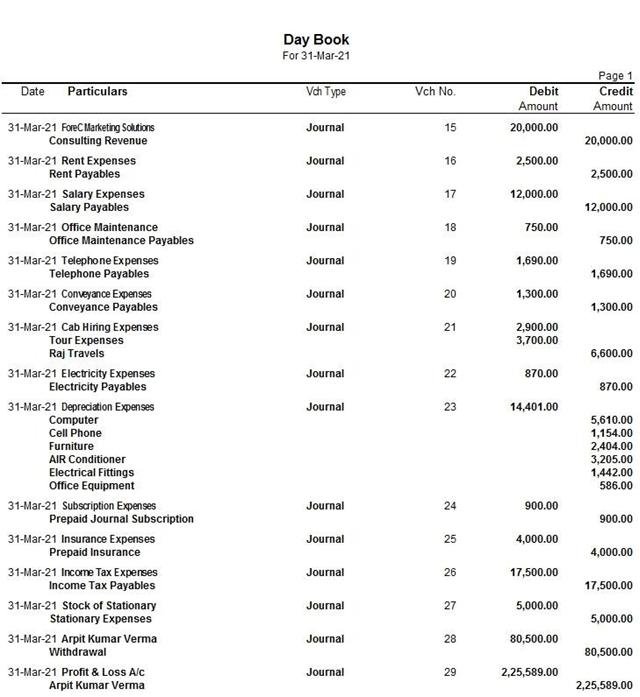

Provision Entries

Transactions after 31-3-2021, pertaining to the year ending March 31, 2021, require provision entries. All provision entries are depicted using Journal Voucher.

Note: Prevision Entries, Depreciation Entries and Adjustment Entries are all recoded as on March 31, 2021.

Provision Entries | |||||||||

144 | 31-3-2021 | Mr. Verma raised an invoice for Rs.20000 on ForeC Marketing Solution for consultancy service. | |||||||

145 | 31-3-2021 | Provision for Rent. | |||||||

146 | 31-3-2021 | Provision for salary. | |||||||

147 | 31-3-2021 | Provision for office maintenance Rs.750. | |||||||

148 | 31-3-2021 | Provision for mobile phone fill charges Rs.1690. | |||||||

149 | 31-3-2021 | Provision for conveyance bills Rs.1300. | |||||||

150 | 31-3-2021 | Mr. Verma received an invoice from Raj travels for Rs.6600. This includes Rs.2900 towards cab hiring charges and Rs.3700 towards outstation tours. | |||||||

151 | 31-3-2021 | Provision for electricity bill Rs.870. | |||||||

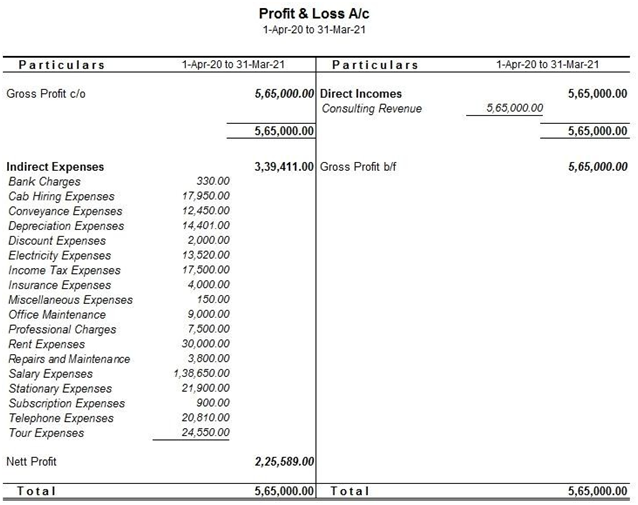

Depreciation Entries | |||||||||

152 | 31-3-2021 | Computer, Cell Phone, Furniture, Air Conditioner, Electrical Fitting, Office Equipment. | |||||||

| S.N | Assets Name | Date of Purchase | Value of Last Financial year (a) | Useful Life on Years (b) | Annual Depreciation (a)/(b)=(c) | Days Used in the year (d) | Depreciation value (c)*(d)/365=(e) |

|

| 1 | Computer | 02-04-20 | 22500 | 4 | 5625 | 364 | 5610 |

|

| 2 | Cell Phone | 15-04-20 | 6000 | 5 | 1200 | 351 | 1154 |

|

| 3 | Furniture | 15-04-20 | 20000 | 8 | 2500 | 351 | 2404 |

|

| 4 | Air Conditioner | 15-04-20 | 20000 | 6 | 3333 | 351 | 3205 |

|

| 5 | Electrical Fittings | 15-04-20 | 15000 | 10 | 1500 | 351 | 1442 |

|

| 6 | Office Equipment | 15-12-20 | 12000 | 6 | 2000 | 107 | 586 |

|

| Total | 14401 |

| ||||||

Adjustment Entries | ||||||||||

153 | 31-3-2021 | Adjustment Entries for Prepaid Expenses (Magazine subscription and Insurance). | ||||||||

| Nature | Payment Date | Period (a) | Amount (b) | Prepaid Period (c) | Prepaid Amount (b)/(a) *(c)=(d) | Amount for Current Year (b)-(d) =(e) |

| ||

| Magazine Subscription | 06-07-20 | 01-07-20 to 30-06-22 (24 months) | 2400 | 01-04-21 to 30- 06-22 (15 months) | 1500 | 900 |

| ||

| Insurance | 01-08-20 | 01-08-20 to 31-07-21 (12 months) | 6000 | 01-04-21 to 31- 07-21 (4 months) | 2000 | 4000 |

| ||

Other Adjustment Entries | ||

154 | 31-3-2021 | Provisions for Income Tax (2020-2021) have to be made at Rs.17500. |

155 | 31-3-2021 | Closing stock of stationary consumables was Rs.5000. |

156 | 31-3-2021 | Transfer balance of withdrawals account to Arpit Kumar Verma Capital A/c. |

Closing Entry | ||

157 | 31-3-2021 | Transfer of Profit and Loss Account to Arpit Kumar Verma Capital A/c. |

Export Closing Balance with All Masters.

Create New Company for New Financial year 2021-2022.

Import Master with Combine opening balance.

Record Transactions of Next Financial Year.

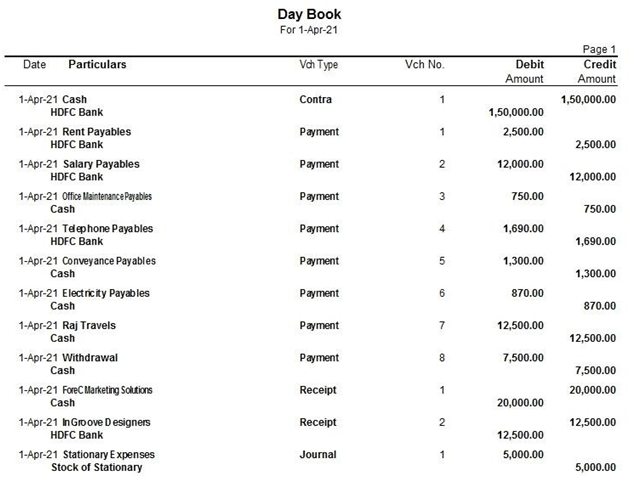

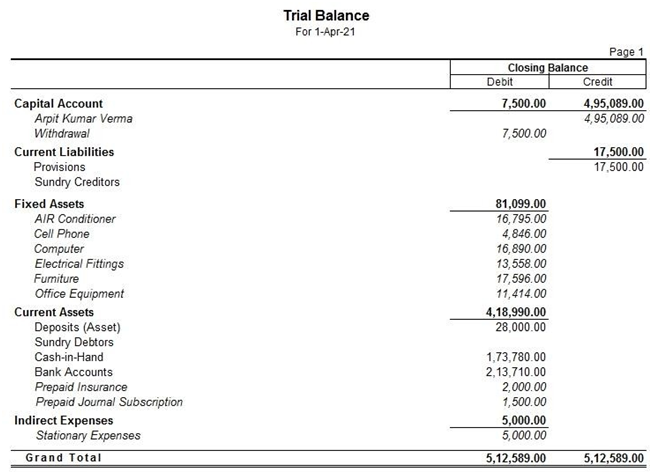

April 2021 | ||

1 | 1-4-2021 | Transfer opening balance of stock of stationary account to stationary expenses account. |

2 | 1-4-2021 | Mr. Verma received Rs.20000 in cash from ForeC Marketing Solutions. |

3 | 2-4-2021 | Mr. Verma paid office rent by cheque. |

4 | 5-4-2021 | Mr. Verma paid salaries by cheque. |

5 | 7-4-2021 | Mr. Verma paid Rs.750 in cash towards office maintenance charges. |

6 | 10-4-2021 | Mr. Verma deposited Rs.150000 cash in HDFC Bank. |

7 | 12-4-2021 | Mr. Verma paid Rs.1690 by cheque towards mobile phone bill charges. |

8 | 15-4-2021 | Mr. Verma reimbursed conveyance bills amounting to Rs.1300 in cash to Geeta Shukla. |

9 | 20-4-2021 | Mr. Verma paid Rs.870 in cash towards electricity charges. |

10 | 21-4-2021 | Mr. Verma received cheque for Rs.12500 from Ingroove Designers. |

11 | 23-4-2021 | Mr. Verma paid Rs.12500 in cash to Raj Travels. |

12 | 30-4-2021 | Mr. Verma withdrew Rs.7500 cash for personal use. |