Tally. ERP 9

Tally Prime is a financial accounting software primarily used by small and medium-sized businesses for managing their accounting and related activities. It allows users to maintain accounts in a systematic order according to accounting rules. Using Tally, one can handle accounting for journal entries, purchases, sales, income & expenses, creditors & debtors, liabilities & assets, etc. It helps manage both accounting and inventory for a business efficiently.

Tally offers many features to simplify these processes. It not only allows you to record accounting transactions easily but also generates various reports such as Trial Balance, Profit & Loss Statement, Balance Sheet, Cash Book, Stock Summary, GST Reports, and more.

Accounting

Accounting helps a business record all its transactions and manage them systematically. The purpose of accounting is to show the financial condition of the business and provide reports. In simple words, it is a systematic way of keeping track of a company’s financial activities.

With the help of accounting, any organization can know how much income it has earned, what its liabilities and debts are, and what its future looks like. It plays an important role in making business decisions.

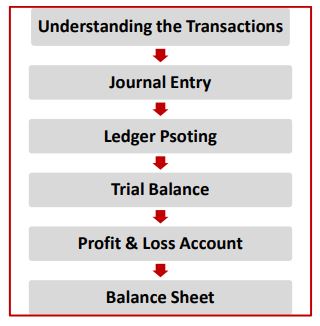

Phases of the Accounting Cycle:

1. Transaction:

A transaction is any activity that happens in a business and affects its financial statements. In accounting, every transaction is recorded as an entry. A transaction can be in cash (paid immediately) or on credit (to be paid later), and it is recorded accordingly.

2. Journal Entry:

A journal entry is the recording of all business transactions, such as purchases, sales, income, expenses, etc., in the accounting books. Each entry is recorded on the debit and credit sides, showing how the transaction affects the accounts.

3. Ledger Posting:

After recording a transaction in Tally, the next step is to transfer (post) it to the respective accounts in the ledger. This process is called ledger posting.

4. Trial Balance:

A trial balance is prepared by calculating the balances of all ledger accounts. It usually has three columns: Particular (account name), Debit, and Credit.

5. Profit & Loss Account:

The Profit & Loss account shows whether a business has made a profit or loss during a period. It has two columns: Expenses and Income. By subtracting expenses from income, we can determine the profit or loss.

6. Balance Sheet:

The balance sheet is very important for any business. It shows the overall financial position of the business, including its net assets and liabilities. It has two columns: Assets and Liabilities

Classification Of Account

- Personal Account

- Real Account

- Nominal Account

Personal Accounting

Accounts created in the name of an individual or organization are called personal accounts. For example, Mohit, Rahul, Bank, ABC Company, Capital, Drawing, etc.

Real Account

Those accounts which are related to some object or property etc. are called Real Accounts. Such as Cash, Computer, Machinery, Furniture, Assets etc.

Nominal Account

Accounts that deal with profit and loss, income and expenditure, and purchase and sale are called Nominal Accounts. Such as Interest, Discount, Wages, Purchases, Sales, Profit & Loss, etc.

Rules of Accounting

Personal Account

- Who is the Reciever

- Debit

- Who is the Giver

- Credit

Real Account

- What come in

- Debit

- Who goes in

- Credit

Nominal Account

- Loss & Expenses

- Credit

- Profit & Income

- Debit

Golden Rules of Accounting

Personal Accounting

The person who receives something is called the Receiver, and is placed in Debit. The person who gives something is called the Giver, and is placed in Credit.

Real Account

Goods that come into a business are recorded as Debit, and those that go out are recorded as Credit.

Nominal Account

Goods that come into a business are recorded as Debit, and those that go out are recorded as Credit.

Types of Account

Asset

Liability

Income/Revenue

Expense/Losses

Increase (+)

Debit

Credit

Credit

Debit

Decrease (-)

Credit

Debit

Debit

Credit

Exercise 1.

1. Mr. Singla Purchased a computer in cash ₹ 18000.

2. Mr. Singla Purchased an Office Table ₹ 3500 and Office Chair ₹ 4000 in cash.

3. Mr. Singla opened a bank account in HDFC bank by deposit cash ₹ 50000.

4. Mr. Singla Purchased stationery item in cash ₹ 2000.

5. Mr. Singla Purchased a mobile phone ₹ 5000 from raj telecom on credit.

6. Mr. Singla withdraw ₹ 10000 from HDFC Bank.

7. Mr. Singla paid cash ₹ 5000 to raj telecom.

8. Mr. Singla received a bill of ₹ 4500 from Sukun offset for printing office

stationery.

9. Mr. Singla withdraw ₹ 4000 from HDFC Bank for personal use.

Introduction to Business Organizations

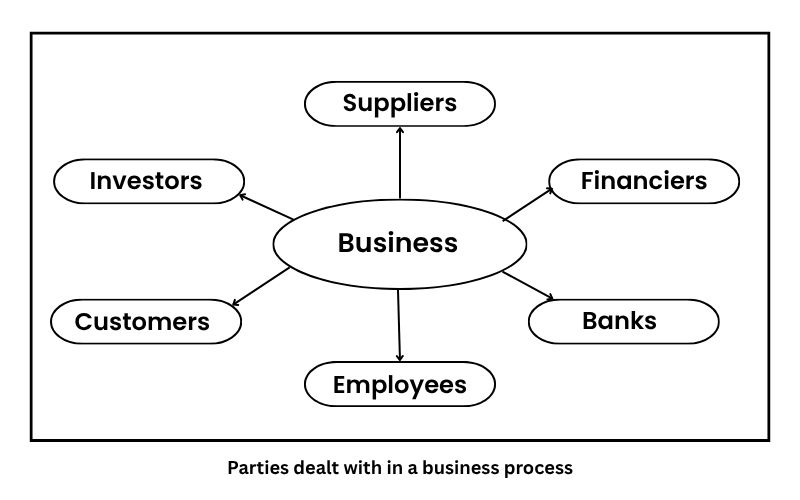

→ In Business

Business organizations conduct different types of transactions, and these can generally be classified as follows:

➢ Service organizations

➢ Trading organizations

➢ Manufacturing organizations

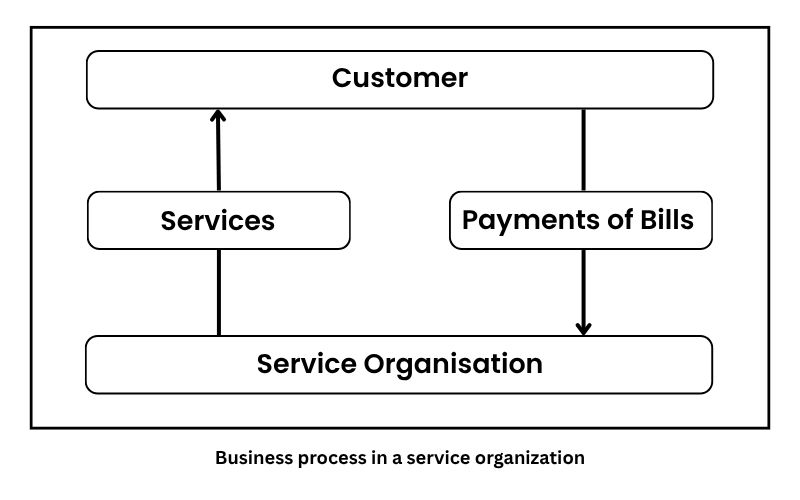

→ Service organizations

Service organizations are those organizations which only provide services, there is no physical transaction of any kind in service organizations, Sf – Teachers, Doctors, Advocate, Consultant etc…….

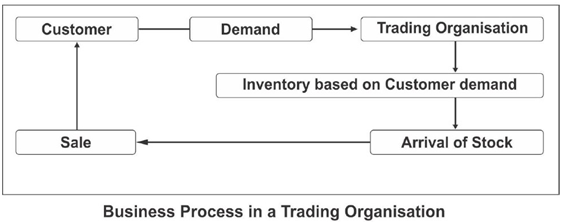

→ trading organizations

Trading organizations buy and sell goods. From this, they determine the cost of production of a particular product and, after adding their profit, sell it.”

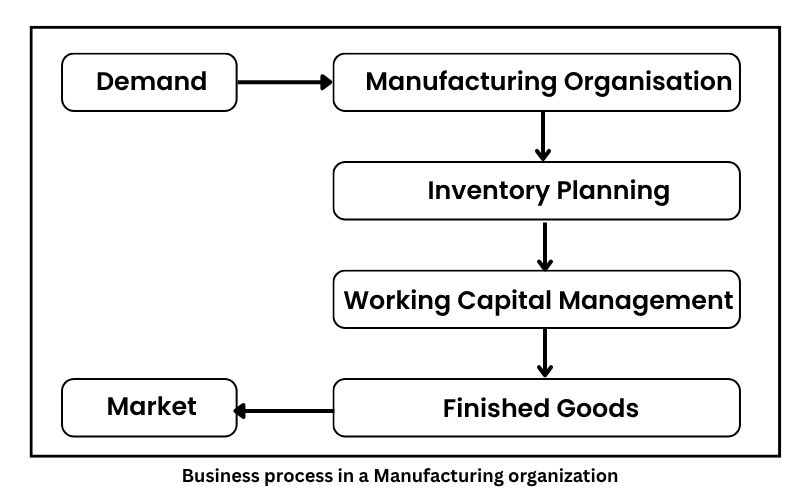

→ Manufacturing organizations

Manufacturing organizations process raw materials into finished goods. In manufacturing organizations, raw materials are prepared through a process, which is then delivered to the customer by trading organizations.

Ledgers, Groups and Voucher

When we enter a transaction in Tally, we first need to open accounts for the accounts mentioned in that entry, i.e., create a ledger. When the same entry is entered a second time, we don’t need to create a ledger for it, because its ledger has already been created. Tally already has a ledger for Cash (cash-in-hand) and Profit & Loss accounts.

When we create an account ledger in Tally, we must specify its group in Tally, which we set under it. To determine which ledger will go into which group, we first need to understand the group and the type of ledger.

For example, Rahul paid ₹2,000 for office rent. Here, rent is a type of expense. So, if rent is an expense, then:

Debit: Rent, Credit: Cash (Ledger – Rent/Under – Indirect Expenses)

Rahul paid ₹2,000 for the next month’s office rent. So, the rent ledger will no longer be created here because it has already been created in the previous month.

Debit: Rent Credit: Cash

A voucher is a type of document that records every transaction we perform in Tally. Tally already has many vouchers created. To determine which voucher will be used for each entry, we need to understand all the types of vouchers, as explained below.

Pre-define Group in Tally

Primary group

- Capital Account Liability

- Loans Liabilities Liability

- Current Liabilities Liability

- Fixed Assets Asset

- Investment Asset

- Current Assets Asset

- Miscellaneous Expenses (Assets) Asset

- Suspense Account Liability

- Branch Division Liability

- Sales Account Income

- Purchase Account Expenses

- Direct Income

- Direct Expenses

- Indirect Income

- Indirect Expenses

Secondary group

1. Reserve & Surplus

2. Bank over Draft

3. Secured Loans

4. Unsecured Loans

5. Duties & Tax

6. Provision

7. Sundry Creditors

8. Sundry Debtors

9. Deposit Assets

10. Loans & Advance Assets

11. Cash in Hand

12. Stock in Hand

13. Bank Account

(Capital Account)

(Loans Liabilities)

(Loans Liabilities)

(Loans Liabilities)

(Current Liabilities)

(Current Liabilities)

(Current Liabilities)

(Current Assets)

(Current Assets)

(Current Assets)

(Current Assets)

(Current Assets)

(Current Assets)

Secondary group

1. Reserve & Surplus

2. Bank over Draft

3. Secured Loans

4. Unsecured Loans

5. Duties & Tax 6. Provision

7. Sundry Creditors

8. Sundry Debtors

9. Deposit Assets 10. Loans & Advance Assets

11. Cash in Hand

12. Stock in Hand

13. Bank Account

(Capital Account)

(Loans Liabilities)

(Loans Liabilities)

(Loans Liabilities)

(Current Liabilities) (Current Liabilities)

(Current Liabilities)

(Current Assets)

(Current Assets)

(Current Assets)

(Current Assets)

(Current Assets)

(Current Assets)

View the pre-defined Group in Tally Prime

Go to Gateway of Tally Prime > Chart of Accounts > Groups.

1. Capital Account :

The capital invested to start a business is called the capital account. When we create a ledger in Tally, we keep it under the Capital Account. Capital can be in any form.

2. Loans Liabilities:

Loans taken by a business are liabilities of the business. These accounts are maintained under Loans Liabilities. For example, Ram mortgaged his house to take a loan of ₹10,000 from Rahul.

(Rahul is a Loans Liability)

3. Current Liabilities:

Accounts for current liabilities are opened under Current Liabilities. For example, advances, loans, and sundry creditors, Ram purchased a computer from Rahul for $5,000 on credit.

(Rahul is a Current Liability (Sundry Creditors))

4. Fixed Assets:

Accounts for all types of fixed assets are maintained under Fixed Assets. Such as buildings, machinery, plots, etc. Ram purchased a cell phone for ₹10,000.

5. Investment Account:

Any type of investment account is maintained under Investment Account. Such as dividend accounts, investment accounts, share accounts, etc.

6. Current Assets:

Accounts for all types of current assets are opened under Current Assets. Such as cash account, bank account, debtors account, advance account, etc.

7. Miscellaneous Exp. Assets:

These are various types of expenses that are initially incurred as additional expenses.

8. Suspense Account:

When the total of the balance sheet is not equal, then the difference amount is deposited in the Suspense Account.

9- Branch Division:

The branch accounts maintained by the main company come under the Branch Division.

10. Sales Account:

Accounts for all types of goods sold, whether on credit or in cash, are maintained under the Sales Account.

11- Purchase Account:

Accounts of all types of purchased goods are maintained under Purchase Account, whether it is on credit or in cash.

12. Direct Income:

All types of direct income that come from the main business are included in direct income.

13- Direct Expenses:

The accounts of expenses incurred directly in business are covered under Direct Expenses.

14. Direct Expenses:

Expenses that are not incurred on a regular basis, such as transport, manufacturing expenses, etc., are kept under direct expenses.

15. Indirect Expenses:

All types of indirect expenses (those incurred on a regular basis) are accounted for under indirect expenses. Such as rent expenses, salary expenses, discount expenses, etc.

16. Reserve & Surplus:

The accounts of the treasury created from the profit are reserve & surplus.

17. Bank Overdraft:

When a bank begins to give more than the deposit amount, it is called a Bank Overdraft. (When we establish an OD limit with the bank.)

18. Secured Loans:

Secured Loans(Home Loan, Gold Loan, Car Loan etc..)

19. Unsecured Loans:

All types of unsecured loans (Personal Loan, Business Loan, Credit Card, Credit Limit)

20. Duties & Taxes:

Accounts of all types of taxes (GST, TDS, VAT) under Duties & Tax

21. Provision:

Accounts for all types of provisions made are maintained under Provision, such as provision for salary, provision for rent.

22. Sundry Creditors:

In business, when we purchase goods on credit from someone, or take any other type of loan, then its account is opened under sundry creditors.

23. Sundry Debtors:

In business, when we sell goods on credit to someone, or give any other type of loan, then its account is opened under sundry debtors.

24. Deposit Assets:

When we deposit money as security for any item, then that account is kept in deposit assets.

25. Loans & Advance assets:

When we give money to someone as an advance, we keep it in this account.

26. Cash-in-hand:

This group is used for all types of cash.

27. Stock-in-hand:

This group is for stock.

28. Bank Account:

Accounts of all types of banks are opened under the bank account group.

Pre-define Voucher in Tally

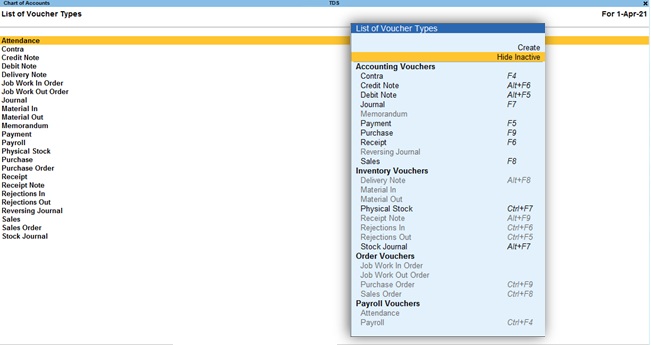

Although there are 24 pre-defined vouchers in Tally Prime, but among them there are 8 common vouchers which are used in almost all types of businesses.

Common Voucher

Contra, Payment, Receipt, Journal, Purchase, Sales, Debit Note, Credit Note.

Special Voucher

Stock Journal, Memorandum, Purchase Order, Sales Order, Delivery Note, Reversing Journal, Receipt Note, Physical Stock, Payroll, Attendance, Job

Work In Order, Job Work Out Order, Material In, Material Out, Rejections In, Rejections Out.

View the Pre-define Voucher types in Tally Prime

Go to Gateway of Tally Prime > Chart of Accounts > Voucher Types.

1. Contra Voucher:

When we transfer cash to bank account or bank balance to cash or make any transfer entry related to bank or cash, we keep it in contra voucher.

2. Payment Voucher:

Whenever we make any kind of payment, whether in cash or by cheque, we make that entry in the payment voucher.

3. Receipt Voucher:

When we receive money in cash or through cheque, we make that entry in the receipt voucher.

4. Journal Voucher:

We use this voucher to make a variety of entries,such as when we lend or borrow money, such as Sundry Creditors or Debtors, Provision, Adjustment entry, etc.

5. Purchase Voucher :

When we purchase goods for sale, we make that entry in the purchase voucher.

6. Sales Voucher :

When we sell goods or services, we make that entry in the sales voucher.

7. Debit Note :

Generally this voucher is used for purchases return entry, i.e. when the purchased goods are returned for some reason.

8. Credit Note :

When the sold goods are returned due to any reason, then its entry is made on the credit note voucher.

9. Stock Journal :

When goods are transferred from one godown to another, that entry is made in the stock journal voucher.

10. Memorandum :

If we need to remember any entry for any reason, then we keep that entry in this voucher.

11. Purchase Order :

When we have to provide a list of items to purchase some goods, we enter that entry in the purchase order voucher and send the list after printing it.

12. Sales Order –

When we receive an order to purchase any goods, we pass that entry in this voucher.

13. Delivery Note –

After receiving the sales order, when we have to deliver the goods to the customer, we use this voucher.

14. Reversing Journal –

If we want to make an entry whose effect will be only on that date, and after that date that entry will not have any effect on any report, then we will make that entry in this voucher.

15. Receipt Note –

After placing a purchase order with the supplier, when we receive the goods, we make an entry on this voucher.

16. Physical Stock –

When we need to verify both the stock summary report of tally and the physical stock lying in our godown, then we use this voucher.

17. Payroll –

When we enter payroll in tally, we use this voucher.

18. Attendance –

We use this voucher to take attendance of employees linked to payroll.

Exercise 2

1. Mr. Singla Started Universal Business Solutions by bringing in cash of ₹ 300000.

2. Mr. Singla Purchased a computer in cash ₹ 18000.

3. Mr. Singla Purchased an Office Table ₹ 3500 and Office Chair ₹ 4000 in cash.

4. Mr. Singla opened a bank account in HDFC bank by deposit cash ₹ 50000.

5. Mr. Singla Purchased stationery item in cash ₹ 2000.

6. Mr. Singla Purchased a mobile phone ₹ 5000 from raj telecom on credit.

7. Mr. Singla withdraw ₹ 10000 from HDFC Bank.

8. Mr. Singla paid cash ₹ 5000 to raj telecom.

9. Mr. Singla received a bill of ₹ 4500 from Sukun offset for printing office stationery.

10. Mr. Singla paid ₹ 2800 by cheque towards office rent.

11. Mr. Singla paid ₹ 700 in cash towards electricity Charge.

12. Mr. Singla issued a cheque of ₹ 4500 for Sukun offset.

13. Mr. Singla withdraw ₹ 4000 from HDFC Bank for personal use.

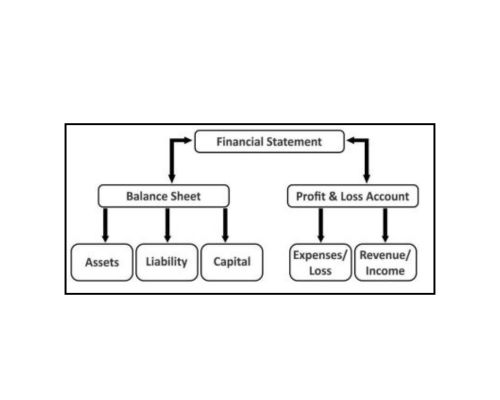

Financial Statements

Financial statements show business expenses, income, purchases, sales, assets, liabilities, etc. on a daily, monthly, or yearly basis. Financial statements typically include a trial balance, profit and loss account, balance sheet, cash book, bank book, stock summary, statutory reports, etc. After entering data into Tally, Tally automatically calculates all these reports.

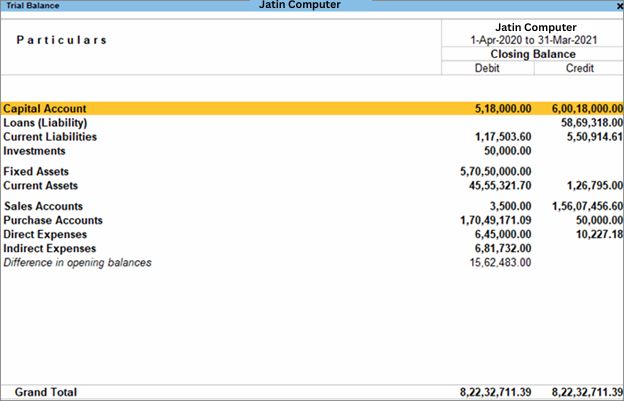

Trial Balance

In a trial balance, all the ledger accounts are calculated and written along with their balances, which has 3 columns. Particular (account name), Debit, Credit.

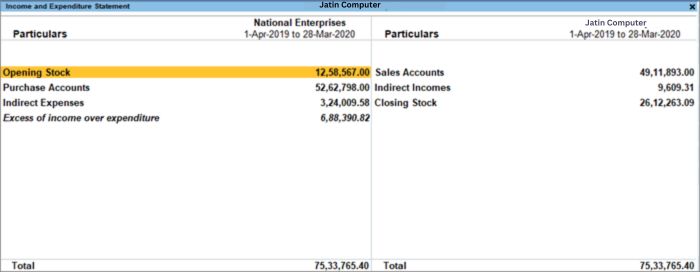

Profit & Loss account

The profit and loss account tells us how much profit or loss a business has. It has two columns: expenses and income. After subtracting income from expenses, we determine whether we have made a profit or a loss.

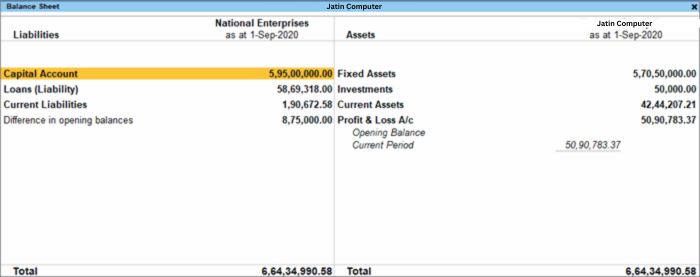

Balance Sheet

The balance sheet is very important in any business because it tells us the actual state of the business, including its net assets and liabilities. It has two columns: Assets and Liabilities.

Cash Book

The cash book tells us how much cash went out of the business, how much came in, and how much remained. It has two columns: Debit Cash and Credit Cash.

Trial Balance

Profit & Loss Account

Balance Sheet

Inventory Management

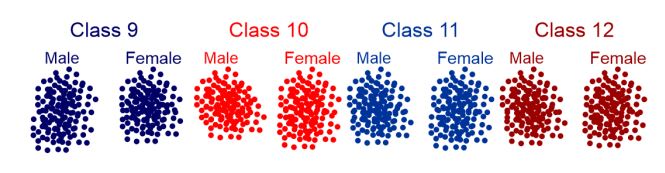

Inventory means a list of items. As we know, trading organizations buy and sell goods. A business contains thousands of items, including items from different companies, sizes, weights, etc. To manage these items, we create stock items, stock groups, stock categories, unit of measure, and warehouses in Tally.With this we can manage the inventory well, and from time to time we can easily check the stock by setting the Stock Summary on different parameters.

To better understand stock item, stock group, and stock category, let’s take the example of college students….

What is Tax?

A tax is a mandatory fee imposed by the government on an individual or organization. The government then spends that money back on the public. According to the law, failure to pay taxes, whether intentionally or accidentally, can result in a fine or punishment.

Types of Taxes

Individuals or organizations must pay taxes in a variety of ways. Tax authorities categorize taxes into direct and indirect taxes, depending on how they collect them.

Difference between Direct and Indirect Taxes

Direct taxes are those taxes that an individual or organization pays directly to the government, such as Income Tax, Property Tax, Stamp Duty, etc.

On the contrary, indirect taxes are those taxes that an individual or organization does not pay directly to the government, but instead shifts the burden to someone else, which is ultimately collected from the consumer. Such as GST, VAT, ED, etc.

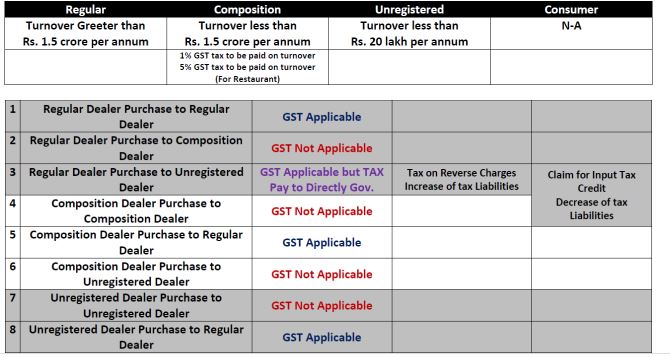

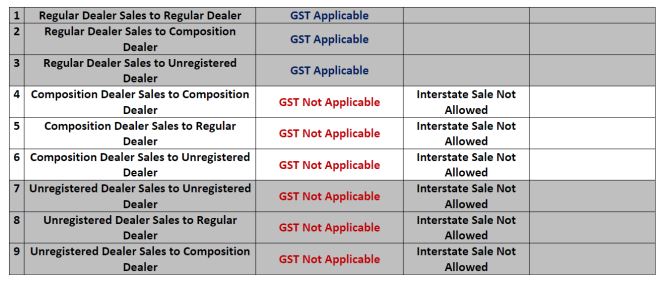

Introduction to GST

GST is a transformative tax reform in our country since independence. It subsumes all indirect taxes currently levied by the central and state governments. GST is called one nation, one tax, and one market.

What is GST

The full form of GST is Goods and Services Tax, which is levied on buying and selling of goods and services, which is an indirect tax, which was implemented on 1-July-2017.

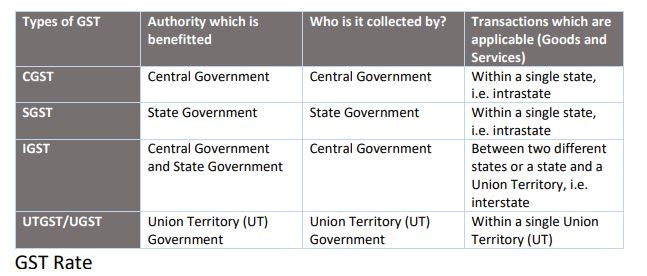

Types of GST

There are 4 types of GST

➢ CGST (Central Goods and Services Tax)

➢ SGST (State Goods and Services Tax)

➢ IGST (Integrated Goods and Services Tax)

➢ UTGST (Union Territory Goods and Services Tax)

0% 5% 12% 18% 28%

Cascading Effect

Cascading tax effect is also termed as “tax on tax”. GST eliminates the cascading effect of all indirect taxes in the supply chain from manufacturers

to retailers, and across state borders.

Exercise 3

1. Mr. Singla Started Business by bringing in cash of ₹ 500000.

2. Mr. Singla opened a bank account in SBI bank by deposit cash ₹ 300000.

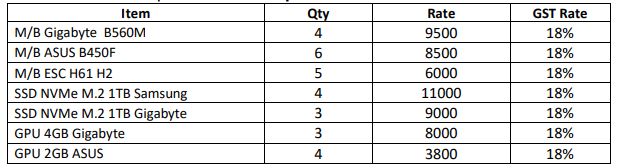

3. Mr. Singla purchased following items from Bansal Computer on credit.

All Stock items are placed in Lakhimpur Godown.

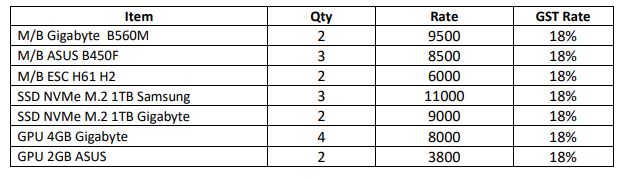

4. Mr. Singla Sold following items from ABC Computer and received cheque.

5. Mr. Singla issued a cheque for Bansal computer of full settlement.

6. Mr. Singla purchased following items from Sri Nath Infosolution on credit.

Terminology of Accounting

- Trade refers to the activity of purchasing and selling goods with the objective of earning profit.

- Profession means any work or occupation that is done to earn revenue and requires special education, training, or skills before starting the work.

- Capital is the amount of money, goods, or assets invested by the owner in the business. Capital increases when the business earns profit and decreases when the business incurs a loss.

- Drawings refer to the money or goods withdrawn by the owner from the business from time to time for personal use.

- Revenue is the income earned from selling goods or providing services in the market.

- Bad Debts when goods are sold on credit, it is not always necessary that the full amount will be received from the debtor. The part of the amount that cannot be recovered is called bad debts.

- Closing Balance at the end of the year, whatever goods, assets, liabilities, etc. remain in the business are known as the closing balance.

- Opening Balance the goods, assets, etc. invested at the time of starting the business, or the closing balance of the previous year, become the opening balance of the new year.

- Financial Year in India, the financial year starts from 1st April.

- Wholesalers purchase goods in bulk from manufacturers and sell them to retailers.

- Retailers purchase goods from wholesalers and sell them to consumers.